HIGHLIGHTS

-

28,512

MLN €

Total Revenue

-

691

MLN €

Operating profit

-

212

MLN €

Profit for the year

-

437

MLN €

Capex

OPERATING RESULTS

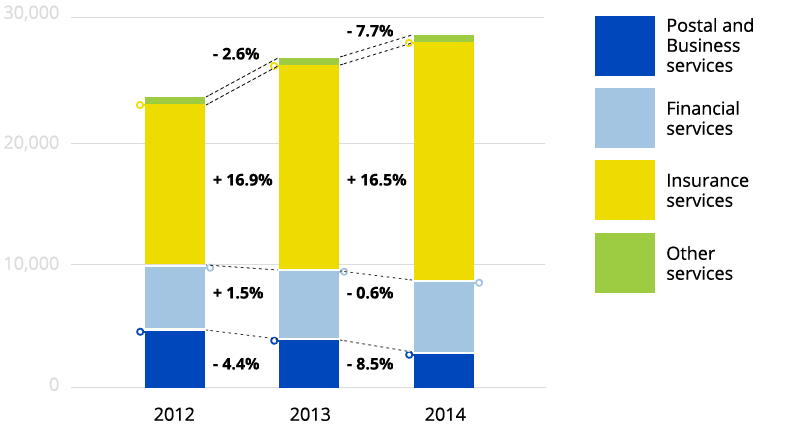

During a year in which the economic environment remained challenging, the overall results of the Poste Italiane Group and its Parent Company reflect positive performances from financial and insurance services, offset by a further decline in traditional postal services, which recorded a progressive reduction in revenue, weighing heavily on the results for the year.

CONSOLIDATED STATEMENT OF PROFIT AND LOSS

| Increase/(decrease) | Year ended 31 December | |||

|---|---|---|---|---|

| (€m) | % | Amount | 2013 | 2014 |

| Revenue from sales and services | (4.9) | (472) | 9,622 | 9,150 |

| Insurance premium revenue | 17.2 | 2,272 | 13,200 | 15,472 |

| Other income from financial and insurance activities | 15.0 | 491 | 3,281 | 3,772 |

| Other operating income | (28.5) | (47) | 165 | 118 |

| Total revenue | 8.5 | 2,244 | 26,268 | 28,512 |

| Cost of goods and services | (3.1) | (86) | 2,734 | 2,648 |

| Net change in technical provisions for insurance business and other claims expenses | 17.1 | 2,617 | 15,266 | 17,883 |

| Other expenses from financial and insurance activities | 2.7 | 2 | 74 | 76 |

| Personnel expenses | 3.7 | 221 | 6,008 | 6,229 |

| Depreciation, amortisation and impairments | 13.9 | 82 | 589 | 671 |

| Capitalised costs and expenses | (47.4) | 27 | (57) | (30) |

| Other operating costs | 35.4 | 90 | 254 | 344 |

| Total ope rating costs | 11.9 | 2,953 | 24,868 | 27, 821 |

| OPERATING PROFIT/(LOSS) | (50.6) | (709) | 1,400 | 691 |

| Finance income | (12.4) | (28) | 226 | 198 |

| Finance costs | 94.9 | 93 | 98 | 191 |

| Profit/(loss) on investments accounted for using the equity method | n/s | (1) | - | (1) |

| PROFIT/(LOSS) BEFORE TAX | (54.4) | (831) | 1,528 | 697 |

| Income tax expense | (35.0) | (261) | 746 | 485 |

| Income tax for previous years following change in legislation | n/s | 223 | (223) | - |

| PROFIT FOR THE YEAR | (78.9) | (793) | 1,005 | 212 |

n/a: not applicable

n/s: not significant

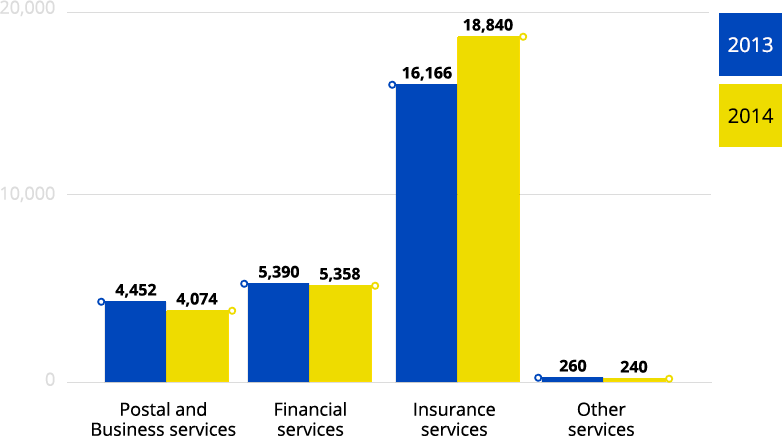

In particular, the Group’s operating profit amounts to €691 million (€1,400 million for 2013), whilst the Parent Company reports a figure of €381million (€917 million for the previous year), reflecting, as already noted, the decline in revenue from Postal and Business services, which is down from the €4,452 million of 2013 to €4,074 million in 2014.

Group – Total revenue by operating segment (data in million euro)

Group’s total revenue of €28,512 million (€26,268 million in 2013) benefitted from the positive contribution from Poste Vita’s premium revenue.

- Postal and Business services: total revenue is down 8.5% (a reduction of €378 million) and continues to suffer from the crisis in traditional forms of communication, reflecting the growing popularity of digital technologies, and the general reduction in demand for products and services, exacerbated by tough price competition.

- Financial services: total revenue, amounting to €5,358 million, is in line with the previous year (down 0.6% on 2013), having benefitted from the positive performance of other income from financial activities.

- Insurance services: the Insurance services provided by the Poste Vita Group have contributed €18,840 million to total revenue, marking growth of 16.5% on the €16,166 million of the previous year.

- Other services: total revenue amounts to €240 million (€260 million in the previous year) and regards the revenue generated by the mobile telecommunications services provided by PosteMobile SpA and Consorzio per I servizi di telefonia Mobile ScpA.

OPERATING RESULTS

The consolidated statement of profit or loss is shown below.

Poste Italiane Group

| Increase/(decrease) | Year ended 31 December | |||

|---|---|---|---|---|

| (€m) | % | Amount | 2013 | 2014 |

| Revenue from sales and services | (4.9) | (472) | 9,622 | 9,150 |

| Insurance premium revenue | 17.2 | 2,272 | 13,200 | 15,472 |

| Other income from financial and insurance activities | 15.0 | 491 | 3,281 | 3,772 |

| Other operating income | (28.5) | (47) | 165 | 118 |

| Total revenue | 8.5 | 2,244 | 26,268 | 28,512 |

| Cost of goods and services | (3.1) | (86) | 2,734 | 2,648 |

| Net change in technical provisions for insurance business and other claims expenses | 17.1 | 2,617 | 15,266 | 17,883 |

| Other expenses from financial and insurance activities | 2.7 | 2 | 74 | 76 |

| Personnel expenses | 3.7 | 221 | 6,008 | 6,229 |

| Depreciation, amortisation and impairments | 13.9 | 82 | 589 | 671 |

| Capitalised costs and expenses | (47.4) | 27 | (57) | (30) |

| Other operating costs | 35.4 | 90 | 254 | 344 |

| Total ope rating costs | 11.9 | 2,953 | 24,868 | 27, 821 |

| OPERATING PROFIT/(LOSS) | (50.6) | (709) | 1,400 | 691 |

| Finance income | (12.4) | (28) | 226 | 198 |

| Finance costs | 94.9 | 93 | 98 | 191 |

| Profit/(loss) on investments accounted for using the equity method | n/s | (1) | - | (1) |

| PROFIT/(LOSS) BEFORE TAX | (54.4) | (831) | 1,528 | 697 |

| Income tax expense | (35.0) | (261) | 746 | 485 |

| Income tax for previous years following change in legislation | n/s | 223 | (223) | - |

| PROFIT FOR THE YEAR | (78.9) | (793) | 1,005 | 212 |

n/a: not applicable

n/s: not significant

During a year in which the economic environment remained challenging, the overall results of the Poste Italiane Group and its Parent Company reflect positive performances from financial and insurance services, offset by a further decline in traditional postal services, which recorded a progressive reduction in revenue, weighing heavily on the results for the year. In particular, the Group’s operating profit amounts to €691 million (€1,400 million for 2013), whilst the Parent Company reports a figure of €381million (€917 million for the previous year), reflecting, as already noted, the decline in revenue from Postal and Business services, which is down from the €4,452 million of 2013 to €4,074 million in 2014. As the reader will be aware, the fact that variable costs have limited impact on the operating performance and that the Company’s cost structure is primarily made up of personnel expenses has a significant impact on margins. In fact, Postal and Business services contributed a loss of €504 million to the consolidated operating result, compared with a profit of €300 million in the previous year.

It should also be noted in relation to this segment, which benefits from intersegment revenue generated on

transactions with BancoPosta RFC, that the Parent Company’s postal operations report an operating loss of €1,154

million, after a partial recovery of its Universal Service costs, as calculated under the regulatory accounting model. This

result marks a deterioration with respect to 2013, when the operating loss was €575 million.

Revenue from Financial services is in line with the figure for 2013 (€5,358 million in 2014, €5,390 million in 2013),

whilst the contribution to operating profit is up 15.5% (€766 million in 2014, compared with €663 million for 2013).

Poste Vita made a significant contribution, reporting an excellent operating performance for the period (€15.4 billion

in premium revenue, up 17%), enabling the company to consolidate its growth.

OPERATING RESULTS OF THE POSTE ITALIANE GROUP

Revenue by operating segment(*)

| Total revenue | Increase/(decrease) | |||

|---|---|---|---|---|

| for the year ended 31 December (€m) | 2013 | 2014 | Amount | % |

| Postal and Business Services | 4,452 | 4,074 | (378) | (8.5) |

| Financial Services | 5,390 | 5,358 | (32) | (0.6) |

| Insurance Services | 16,166 | 18,840 | 2,674 | 16.5 |

| Other Services | 260 | 240 | (20) | (7.7) |

| Total Poste Italiane Group | 26,268 | 28,512 | 2,244 | 8.5 |

(*) After consolidation adjustments and elimination of intercompany transactions.

Group - Total revenue

| Revenues from sales and services | % | Insurance premium revenue | % | Other income from financial and insurance activities | % | Other operating income | % | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| for the year ended 31 December (€m) | 2013 | 2014 | inc./ (dec.) | 2013 | 2014 | inc./ (dec.) | 2013 | 2014 | inc./ (dec.) | 2013 | 2014 | inc./ (dec.) |

| Postal and Business Services | 4,309 | 3,964 | (8.0) | - | - | - | - | - | - | 143 | 110 | (23.1) |

| Financial Services | 5,068 | 4,950 | (2.3) | - | - | - | 315 | 404 | 28.3 | 7 | 4 | (42.9) |

| Insurance Services | - | - | - | 13,200 | 15,472 | 17.2 | 2,966 | 3,368 | 13.6 | - | - | - |

| Other Services | 245 | 236 | (3.7) | - | - | - | - | - | - | 15 | 4 | (73.3) |

| Total Poste Italiane Group | 9,622 | 9,150 | (4.9) | 13,200 | 15,472 | 17.2 | 3,281 | 3,772 | 15.0 | 165 | 118 | (28.5) |

The Group’s Postal and Business services

| Total revenue for the year ended 31 December | Increase/ (decrease) | |||||

|---|---|---|---|---|---|---|

| (€m) | 2013 | 2014 | Amount | % | ||

| Poste Italiane SpA(*) | 3,793 | 3,545 | ||||

| of which: intercompany revenue | 59 | 279 | ||||

| Poste Italiane SpA - external revenue | 3,734 | 3,266 | (468) | (12.5) | ||

| SDA Express Courier SpA | 477 | 511 | ||||

| of which: intercompany revenue | 105 | 116 | ||||

| SDA Express Courier SpA - external revenue | 372 | 395 | 23 | 6.1 | ||

| Gruppo Postel | 354 | 318 | ||||

| of which: intercompany revenue | 186 | 171 | ||||

| Gruppo Postel - external revenue | 168 | 147 | (21) | (12.5) | ||

| Italia Logistica Srl | 67 | 69 | ||||

| of which: intercompany revenue | 29 | 33 | ||||

| Italia Logistica Srl - external revenue | 38 | 36 | (2) | (5.3) | ||

| Mistral Air Srl | 103 | 131 | ||||

| of which: intercompany revenue | 36 | 36 | ||||

| Mistral Air Srl - external revenue | 67 | 95 | 28 | 41.8 | ||

| PosteShop SpA | 29 | 23 | ||||

| of which: intercompany revenue | 1 | 1 | ||||

| PosteShop SpA - external revenue | 28 | 22 | (6) | (21.4) | ||

| Postecom SpA | 117 | 91 | ||||

| of which: intercompany revenue | 99 | 82 | ||||

| Postecom SpA - external revenue | 18 | 9 | (9) | (50.0) | ||

| Altre società | 355 | 444 | ||||

| of which: intercompany revenue | 328 | 340 | ||||

| Other companies - external revenue | 27 | 104 | 77 | n/s | ||

| Total external revenue | 4,452 | 4,074 | (378) | (8.5) | ||

n/s: not significant

(*) This item includes Postal services revenue, other revenue from the sale of goods and services and other operating income. It does

not take into account the portion attributable to BancoPosta RFC.

As noted above, the Group’s total revenue of €28,512 million (€26,268 million in 2013) benefitted from the positive

contribution from Poste Vita’s premium revenue.

Taking a closer look, total revenue from Postal and Business services is down 8.5% (a reduction of €378 million) and

continues to suffer from the crisis in traditional forms of communication, reflecting the growing popularity of digital

technologies, and the general reduction in demand for products and services, exacerbated by tough price

competition.

Total revenue from Financial services, amounting to €5,358 million, is in line with the previous year (down 0.6% on

2013), having benefitted from the positive performance of other income from financial activities, which is up from the

€315 million of 2013 to €404 million in 2014. This category of revenue includes income from investments in fixed

income Italian government securities, purchased with the aim of anticipating renewal of BancoPosta’s investments

close to maturity.

The Insurance services provided by the Poste Vita Group have contributed €18,840 million to total revenue, marking

growth of 16.5% on the €16,166 million of the previous year.

Total revenue from Other services amounts to €240 million (€260 million in the previous year) and regards the

revenue generated by the mobile telecommunications services provided by PosteMobile SpA and Consorzio per i

servizi di telefonia Mobile ScpA.

COST ANALYSIS

| for the year ended 31 December (€m) | 2013 | 2014 | % inc./ (dec.) |

|---|---|---|---|

| Cost of goods and services | 2,734 | 2,648 | (3.1) |

| Net change in technical provisions for insurance business and other claims expenses | 15,266 | 17,883 | 17.1 |

| Other expenses from financial and insurance activities | 74 | 76 | 2.7 |

| Personnel expenses | 6,008 | 6,229 | 3.7 |

| Depreciation, amortisation and impairments | 589 | 671 | 13.9 |

| Capitalised costs and expenses | (57) | (30) | (47.4) |

| Other operating costs | 254 | 344 | 35.4 |

| Total operating costs | 24,868 | 27,821 | 11.9 |

The cost of goods and services is down 3.1% from €2,734 million in 2013 to €2,648 million in 2014, reflecting a

reduction in the cost of funding, represented by interest paid to private customers by BancoPosta RFC and the

interest payable to major financial institutions acting as counterparties in repurchase agreements.

The increase in technical provisions for the insurance business and other claims expenses, which is closely linked to

the above growth in premium revenue recorded by Poste Vita, amounts to €17,883 million and is up 17.1% on the

previous year.

Other expenses from financial and insurance activities of €76 million is in line with the previous year (€74 million in

2013).

Personnel costs

| Increase/(decrease) | ||||

|---|---|---|---|---|

| for the year ended 31 December (€m) | 2013 | 2014 | Amount | % |

| Salaries, social security contributions and sundry expenses(*) | 5,906 | 5,832 | (74) | (1.3) |

| Redundancy payments | 53 | 152 | 99 | n/s |

| Net provisions (uses) for disputes | (45) | (11) | 34 | (75.6) |

| Provisions for restructuring charges | 114 | 256 | 142 | n/s |

| Total | 6,028 | 6,229 | 201 | 3.3 |

| Income from fixed-term and temporary contract agreements | (20) | - | 20 | n/s |

| Total personnel expenses | 6,008 | 6,229 | 221 | 3.7 |

n/s: not significant

(*) This includes the following items described in note C8 to the consolidated financial statements: salaries and wages; social

security contributions; employee termination benefits; temporary work; Directors’ fees and expenses; other costs (cost recoveries).

Ordinary personnel expenses, linked to salaries, contributions and sundry expenses, are down 1.3% (a reduction of

€74 million) on 2013, reflecting a decrease in the average workforce employed during the year (approximately 800

fewer Full-Time Equivalent staff employed on average in 2014, compared with the previous year) and a reduction in

costs compared with 2013, when the figure was influenced by additional pay caused by 3 public holidays falling on

a Sunday. The reduction also reflects payments relating to renewal of the national collective contract and payment, in

2013, of a bonus based on the achievement of certain operating results by the Group, in accordance with specific

union agreements.

Personnel expenses also reflect an increase in redundancy payments, which are up from €53 million in 2013 to €152

million in 2014, and provisions for restructuring charges of €256 million (provisions of €114 million in 2013), made to

cover the estimated costs to be incurred by the Parent Company for early retirement incentives, under the current

redundancy scheme for employees leaving the Company by 31 December 2016.

Finally, the change in personnel expenses also reflects income of €20 million recognised by the Parent Company in

2013, following the agreements of March 2013 between the Parent Company and the labour unions, regarding the

re-employment by court order of staff previously employed on fixed-term contracts.

Total personnel expenses are thus up 3.7% from the €6,008 million of 2013 to €6,229 million in 2014.

The above movements in revenue and costs have resulted in operating profit of €691 million (€1,400 million in 2013), as shown in the following table.

OPERATING PROFIT: BY OPERATING SEGMENT

| Increase/(decrease) | ||||

|---|---|---|---|---|

| for the year ended 31 December (€m) | 2013 | 2014 | Amount | % |

| Postal and Business Services | 300 | (504) | (804) | n/s |

| Financial Services | 663 | 766 | 103 | 15.5 |

| Insurance Services | 411 | 415 | 4 | 1.0 |

| Other Services | 25 | 14 | (11) | (44.0) |

| Elimination(*) | 1 | - | (1) | n/s |

| Total Poste Italiane Group | 1,400 | 691 | (709) | (50.6) |

n/s: not significant

(*) Elimination of costs incurred by Poste Italiane SpA for interest paid to consolidated subsidiaries (recognised by the latter in finance income)

Net finance income of €6 million (€128 million in 2013) reflects, among other things, the impairment loss recognised on the investment in Alitalia-CAI SpA (€75 million).

Income tax expense is down from €746 million in 2013 to €485 million in 2014.

The effective tax rate for 2014 is 69.58%, consisting of the sum of the IRES tax rate (34.69%) and the IRAP tax rate

(34.89%). Compared with the figure for 2013, when the effective tax rate was 34.26%, it should be noted that the

previous year benefitted from the positive impact of recognition of an IRES refund for the years from 2004 to 2006, in

accordance with Law Decree 201 of 6 December 2011 (resulting in a reduction in the tax rate of 14.57%). In

addition, the rate for 2014 reflects the greater impact of the non-deductibility of personnel expenses for the purposes

of IRAP, due to the fact that profit before tax is lower than for the previous year.

Profit for the year ended 31 December 2014 thus amounts to €212 million (€1,005 million for 2013).

OPERATING RESULTS OF POSTE ITALIANE SPA

Revenue

| Increase/(decrease) | ||||

|---|---|---|---|---|

| for the year ended 31 December (€m) | 2013 | 2014 | Amount | % |

| Mail and Philately | 3.025 | 2.713 | (312) | (10.3) |

| Express Delivery and Parcels | 123 | 140 | 17 | 13.8 |

| Total market revenue from Postal services(*) | 3.148 | 2.853 | (295) | (9.4) |

| BancoPosta services | 5.326 | 5.228 | (98) | (1.8) |

| Other revenue | 105 | 96 | (9) | (8.6) |

| Market revenue | 8.579 | 8.177 | (402) | (4.7) |

| Universal Service Obligation (USO) compensation(*) | 343 | 277 | (66) | (19.2) |

| Electoral subsidies(*) | 56 | 17 | (39) | (69.6) |

| Total revenue from sales and services | 8.978 | 8.471 | (507) | (5.6) |

| Other income from financial activities | 308 | 389 | 81 | 26.3 |

| Other operating income | 147 | 306 | 159 | n/s |

| Total revenue attributable to Poste Italiane SpA | 9.433 | 9.166 | (267) | (2.8) |

| (*) Market revenue from Postal Services | 3.148 | 2.853 | ||

| USO compensation | 343 | 277 | ||

| Electoral subsidies(**) | 56 | 17 | ||

| Total Postal services | 3.547 | 3.147 | (400) | (11.3) |

To ensure the comparability of amounts for the two years, certain amounts for 2013 have been reclassified.

(**) Subsidies for tariffs discounted in accordance with the law.

n/s: not significant

Poste Italiane SpA’s revenue from sales and services amounts to €8,471 million for 2014, down 5.6% on the figure for

2013 (revenue of €8,978 million in the previous year). As noted in the review of the Group’s results, this performance

is due to the downturn in revenue from postal and business services market, reflecting a decline in demand for

traditional mail services, above all from major customers due to both e-substitution, where electronic forms of

communication replace paper forms (individual letters replaced by e-mails, bank statements and bills made available

on line, etc.), and a tendency among companies to reduce their dependence on business post in order to cut their

operating costs.

As a result, market revenue from mail and philately services is down 10.3% on 2013 (a reduction of €312 million),

reflecting a 10.4% reduction in volumes (431 million fewer items sent in 2014, compared with 2013). This is primarily

due to the negative performances registered by Unrecorded Mail (volumes down 14.5% and revenue down 14.6%),

Recorded Mail (volumes down 6.7% and revenue down 8.1%) and Direct Marketing (volumes down 5.8% and

revenue down 6.7% on the previous year), the latter market having been hard hit by the economic downturn of

recent years. The performance of the postal services segment also reflects growing use of digital forms of

communication between government agencies and the public.

The only area showing any signs of growth is the Express Delivery and Parcels segment, where revenue is up 13.8%

from the €123 million of 2013 to €140 million in 2014, thanks to the Company’s commitment to developing its e-Commerce offering.

The compensation partially covering the cost of the universal service for 2014 has been determined taking into

account the limits represented by the amount earmarked for this purpose in the Government’s budget, contained in

art.1, paragraph 274 of Law 190 of 23 December 2014 – Provisions concerning development of the Annual and

Multi-year Budget (the 2015 Stability Law). The cost incurred by Poste Italiane SpA was calculated using the new “net avoided cost” method, introduced by EU Directive 2008/6/EC and transposed into Italian law by Legislative Decree

58 of 31 March 2011(1). The compensation, amounting to €277 million, is in any event significantly lower than the

actual costs incurred, as calculated by the Company.

Market revenue from BancoPosta services amounts to €5,228 million (€5,326 million in 2013), marking a slight

decline (down 1.8%) due to both a reduction in the return on the mandatory deposit of the current account deposits

of Public Sector customers with the Ministry of the Economy and Finance (the rate of interest received has fallen from

the 2.61% of 31 December 2013 to 1.34% at 31 December 2014), and a reduction in fees generated by the

processing of bills paid by payment slip, reflecting a decline in the number of payment slips handled.

Other income from the sale of goods and services, not specifically attributable to postal or financial activities, amounts

to €96 million (€105 million in 2013).

Other income from financial activities is up from €308 million in 2013 to €389 million in 2014, essentially reflecting the

gain realised on the sale of financial assets attributable to BancoPosta RFC.

Finally, other operating income contributed €306 million (€147 million in the previous year) to total revenue (€9,166

million in 2014, compared with €9,433 million in 2013), including €201 million in dividends from subsidiaries.

COST ANALYSIS

| for the year ended 31 December (€m) | 2013 | 2014 | % inc./ (dec.) |

|---|---|---|---|

| Cost of goods and services | 2,025 | 1,921 | (5.1) |

| Other expenses from financial activities | 7 | 6 | (14.3) |

| Personnel expenses | 5,755 | 5,972 | 3.8 |

| Depreciation, amortisation and impairments | 501 | 578 | 15.4 |

| Capitalised costs and expenses | (5) | (6) | 20.0 |

| Other operating costs | 233 | 314 | 34.8 |

| Total operating costs | 8,516 | 8,785 | 3.2 |

Operating costs incurred in 2014 are up 3.2% (an increase of €269 million on 2013), primarily due to personnel

expenses, as described below.

A closer look shows that the cost of goods and services is down €104 million (5.1%), due primarily to a reduction in

interest expense (down €102 million on 2013) paid to BancoPosta’s private customers and to major financial

institutions acting as counterparties in repurchase agreements.

Depreciation, amortisation and impairments, which have risen from €501 million in 2013 to €578 million in 2014,

include impairment losses primarily on industrial buildings owned by the Company (buildings used in operations)

and commercial buildings leased by the Company (leasehold improvements). These impairments have been

recognised following a prudent assessment of the impact on their value in use, should the future use of such assets in

operations be reduced or halted.

Other operating costs are up from €233 million in 2013 to €314 million in 2014, reflecting, among other things, an

increase in provisions linked to the procedures and timing involved in the collection of amounts receivable from the

parent.

Personnel expenses break down as follows.

Personnel expenses

| Increase/(decrease) | ||||

|---|---|---|---|---|

| for the year ended 31 December (€m) | 2013 | 2014 | Amount | % |

| Salaries, social security contributions and sundry expenses(*) | 5,655 | 5,571 | (84) | (1.5) |

| Redundancy payments | 53 | 151 | 98 | n/s |

| Net provisions for disputes | (47) | (6) | 41 | (87.2) |

| Provisions for restructuring charges | 114 | 256 | 142 | n/s |

| Total | 5,775 | 5,972 | 197 | 3.4 |

| Income from fixed-term and temporary contract agreements | (20) | - | 20 | n/s |

| Total personnel expenses | 5,755 | 5,972 | 217 | 3.8 |

n/s: not significant

(*) This includes the following items: salaries and wages; social security contributions; employee termination benefits; temporary work;

Directors’ fees and expenses; other costs (cost recoveries).

Ordinary personnel expenses, linked to salaries, contributions and sundry expenses, which are down 1.5% (a

reduction of €84 million) on 2013, reflecting a decrease in the average workforce employed during the year (more

than 900 fewer Full-Time Equivalent staff employed on average in 2014) and a reduction in costs compared with

2013, when the figure was influenced by additional pay caused by 3 public holidays falling on a Sunday. The

reduction also reflects payments relating to renewal of the national collective contract and payment, in 2013, of a

bonus based on the achievement of certain operating results by the Group, in accordance with specific union

agreements.

Personnel expenses also reflect an increase in redundancy payments, which are up from €53 million in 2013 to €151

million in 2014, and provisions for restructuring charges of €256 million (provisions of €114 million in 2013), made to

cover the estimated costs to be incurred by the Company for early retirement incentives, under the current

redundancy scheme for employees leaving the Company by 31 December 2016.

Personnel expenses also benefit from net releases of €6 million from provisions for disputes (net releases of €47 million

in 2013), reflecting updated estimates of the liabilities and related legal expenses, based on both the overall level of

claims actually paid and application of the so-called Collegato lavoro legislation, which has introduced a cap on

compensation payable on current and future claims brought by workers on fixed-term contracts, who have been reemployed

on permanent contracts by court order.

Finally, the change in personnel expenses also reflects income of €20 million recognised by Poste Italiane in 2013,

following the agreements of March 2013 between the Company and the labour unions, regarding the reemployment

by court order of staff previously employed on fixed-term contracts.

Again with regard to fixed-term contracts, the Company employed 8,052 people on fixed-term contracts in 2014

(8,149 in 2013), equal to 7,743 FTEs (7,946 FTEs in 2013). As a result of specific measures establishing quotas

limiting the use of such contracts, the following should be noted: the permanent workforce at 1 January 20142

totalled 143,422 (144,087 at 1 January 2013), equal to 137,983 FTEs (138,877 FTEs at 1 January 2013); the number

of people on fixed-term contracts as defined by art. 2, paragraph 1-bis of Legislative Decree 368/013 – the so-called

“causale finanziaria” – amounted to 2,388, equal to 2,345 FTEs; the number of people on fixed-term contracts as

defined by art. 1, paragraph 1 of Legislative Decree 368/01, as amended by Law Decree 34/144 - the so-called “Jobs

Act” - amounted to 4,496, equal to 4,260 FTEs5.

Total personnel expenses are up 3.8% from €5,755 million in 2013 to €5,972 million in 2014.

Net finance costs total €108 million (net finance income of €47 million in 2013), reflecting, among other things, the impairment loss recognised on the investment in Alitalia-CAI SpA (€75 million).

Income tax expense is down from the €474 million of 2013 to €216 million for 2014.

The total effective tax rate for 2014 is 79.16%. Compared with the figure for 2013, when the rate was 26.54%, it

should be noted that the previous year benefitted from the positive impact of recognition of an IRES refund for the

years from 2004 to 2006, in accordance with Law Decree 201 of 6 December 2011 (resulting in a reduction in the

tax rate of 22.59%).

In terms of the composition of the tax rate, the effective rates for IRAP and IRES in 2014 are 72.71% and 6.45%,

respectively; the significant reduction in the effective tax rate for IRES, compared with the statutory rate of 27.5%,

primarily reflects the deductibility (95%) of dividends received from certain subsidiaries.

Profit for 2014 thus amounts to €57 million (€708 million for 2013), despite benefitting from the profit reported by BancoPosta RFC (€440 million), which was unable to offset the losses incurred by the postal business.

(1) This method defines the cost incurred as the difference between the net operating cost incurred by a designated universal service

provider when subject to universal service obligations and the net operating cost without such obligations. Application of the

method requires a series of assumptions in order to construct the hypothetical postal operator without obligations, on which to

base assessment of the related net costs and revenues.

(2) The workforce at 1 January of each year is identical to the workforce at 31 December of the previous year.

(3) Art. 2, paragraph 1-bis of Legislative Decree 368/01 requires, among other things, that fixed-term contracts must not represent

more than 15% of a company’s workforce on 1 January of the year in which the staff are recruited.

(4) Art. 1, paragraph 1 of Legislative Decree 368/01, as amended by Law Decree 34/14 (the so-called “Jobs Act”) establishes, among

other things, that employees recruited on fixed-term contracts cannot exceed 20% of a company’s permanent workforce at 1

January of the year in which they are recruited, after rounding up to the nearest whole number should the figure be equal to or

above 0.5.

(5) The number of fixed-term contracts – expressed in terms of both headcount and FTEs – includes, for 2014, both contracts and

renewals during the year in question. In fact, given that Law Decree 34/14 came into force on 21 March 2014, there were no

contracts in effect at 1 January of that year previously executed in accordance with the Jobs Act.

Financial position and cash flow

The Poste Italiane Group’s net invested capital amounts to €3,677 million (€3,859 million at 31 December 2013), 100% financed by equity.

NET INVESTED CAPITAL

In addition to movements in non-current assets and working capital, the reduction in net invested capital at 31 December 2014 reflects:

- a reduction of €513 million in the net balance of deferred tax assets/(liabilities), primarily due to the increase in the fair value reserve for BancoPosta’s investments in securities, which generated an increase in deferred tax liabilities;

- an increase of €168 million in provisions for risks and charges, primarily due to the effect of the expected liabilities for restructuring costs.

| at 31 December (€m) | 2013 | 2014 | Increase/ (decrease) |

|---|---|---|---|

| Non-current assets | 3,145 | 2,893 | (252) |

| Working capital | 3,052 | 3,941 | 889 |

| Provisions for risks and charges | (1,166) | (1,334) | (168) |

| Employee termination benefits and pension plans | (1,340) | (1,478) | (138) |

| Deferred tax assets/(liabilities) | 168 | (345) | (513) |

| Net invested capital | 3,859 | 3,677 | (182) |

NET FUNDS

Net funds at 31 December 2014 amount to €4,741 million (net funds of €3,257 million at the end of 2013), reflecting:

- the results of the fair value measurement of investments in available-for-sale financial assets (approximately €2,650 million);

- cash subject to restrictions, as shown in the following table, as attributable to technical provisions for the insurance business or subject to investment restrictions (BancoPosta RFC);

- net financial assets held by Poste Vita and Banca del Mezzogiorno-MedioCredito Centrale, which are subject to supervisory capital requirements (approximately €1,900 million).

| at 31 December (€m) | 2013 | 2014 |

|---|---|---|

| Financial liabilities | 51,770 | 55,358 |

| Technical provisions for insurance business | 68,005 | 87,219 |

| Financial assets | (118,467) | (142,687) |

| Technical provisions for claims attributable to reinsurers | (40) | (54) |

| Net financial liabilities/(assets) | 1,268 | (164) |

| Cash and deposits attributable to BancoPosta | (3,080) | (2,873) |

| Cash and cash equivalents | (1,445) | (1,704) |

| of which: | ||

| - Adjusted cash and cash equivalents | (559) | (778) |

| - Cash subject to investment restrictions | (262) | (511) |

| - Cash attributable to technical provisions for insurance business | (624) | (415) |

| Net debt/(funds) | (3,257) | (4,741) |

FINANCIAL POSITION AND CASH FLOW

FINANCIAL POSITION AND CASH FLOW OF THE POSTE ITALIANE GROUP

| at 31 December (€m) | 2013 | 2014 | Increase/ (decrease) |

|---|---|---|---|

| Non-current assets | 3,145 | 2,893 | (252) |

| Working capital | 3,052 | 3,941 | 889 |

| Provisions for risks and charges | (1,166) | (1,334) | (168) |

| Employee termination benefits and pension plans | (1,340) | (1,478) | (138) |

| Deferred tax assets/(liabilities) | 168 | (345) | (513) |

| Net invested capital | 3,859 | 3,677 | (182) |

In addition to movements in non-current assets and working capital, the reduction in net invested capital at 31 December 2014 reflects:

- a reduction of €513 million in the net balance of deferred tax assets/(liabilities), primarily due to the increase in the fair value reserve for BancoPosta’s investments in securities, which generated an increase in deferred tax liabilities;

- an increase of €168 million in provisions for risks and charges, primarily due to the effect of the expected liabilities for restructuring costs.

Non-current assets break down as follows at 31 December 2013 and 31 December 2014:

| at 31 December (€m) | 2013 | 2014 | Increase/ (decrease) |

|---|---|---|---|

| Property, plant and equipment | 2,490 | 2,296 | (194) |

| Investment property | 69 | 67 | (2) |

| Intangible assets | 577 | 529 | (48) |

| Investments accounted for using the equity method | 9 | 1 | (8) |

| Non-current assets | 3,145 | 2,893 | (252) |

Compared with the end of 2013, non-current assets are down €251.5 million, as a result of reductions of €689.5

million and additions totalling €438.0 million.

Reductions regard depreciation, amortisation and impairments, totalling €670.8 million, of which €409.0 million

regards property, plant and equipment, €257.4 million intangible assets and €4.4 million depreciation and

impairments of investment property, after reversals of impairments.

Further reductions in non-current assets regard:

- retirements and sales of €10.9 million, including €7.7 million regarding intangible assets, €2.4 million property, plant and equipment, €0.6 million investment property and €0.2 million non-current assets held for sale;

- Postel SpA sale of shares in Docugest SpA, totalling €4.5 million, to Cedacri Global Service SpA;

- the net impact of changes in the scope of consolidation, totalling €2.3 million, reflecting consolidation on a lineby- line basis, from 1 January 2014, of PatentiViaPoste ScpA and PosteTributi ScpA;

- net adjustments of the value of investments, totalling €1.0 million. An adjustment of €0.6 million refers to the investment in Docugest SpA, the value of which was aligned with the sale price on 4 July 2014.

Additions regard:

- the purchase of property, plant and equipment, totalling €219.6 million, primarily by the Parent Company and attributable to the purchase of new hardware for the technological upgrade and restyling of the Group’s post offices, in addition to non-routine maintenance of properties owned by the Group;

- the investment of €217.5 million in intangible assets, regarding the purchase of new software licences and the development of network platforms1 by the Parent Company and Group companies;

- purchases of investments, totalling €393 thousand, essentially including (€391 thousand) subscription for the new shares issued by Poste Holding Participações do Brasil Ltda (76% owned by Poste Italiane SpA and 24% owned by PosteMobile SpA). Moreover, following the decision to put the Virtual Mobile Network Operator project in Brazil on hold, on 27 November 2014, Poste Italiane SpA’s Board of Directors decided to put the company into liquidation. A further €2 thousand regards the Parent Company’s acquisition of 20% of Italia Camp Srl.

- purchases of investment property, totalling €0.5 million.

Working capital of breaks down as follows at 31 December 2014 and 31 December 2013:

| at 31 December (€m) | 2013 | 2014 | Increase/ (decrease) |

|---|---|---|---|

| Inventories | 145 | 139 | (6) |

| Trade receivables and other current receivables and assets | 4,575 | 5,232 | 657 |

| Trade payables and other current liabilities | (3,390) | (3,317) | 73 |

| Current tax assets and liabilities | 617 | 634 | 17 |

| Trade receivables and other non-current assets and liabilities | 1,105 | 1,253 | 148 |

| Working capital | 3,052 | 3,941 | 889 |

Working capital at 31 December 2014 amounts to €3,941 million, up €889 million compared with the end of 2013. The increase is essentially due to the following.

- An increase of €657 million in trade receivables and other current receivables and assets. The main components of this balance include receivables due from the State; in particular, €535 million regards recognition of an amount due from the shareholder which, as provided for in art.1, paragraph 281 of the 2015 Stability Law (Law 190 of 23 December 2014), is due to the return of amounts deducted from the Parent Company’s retained earnings on 17 November 2008 and transferred to the MEF, pursuant to the European Commission’s Decision C42/2006 of 16 July 2008 (described in greater detail in section 10.1, “Principal proceedings and relations with e authorities”). In addition, a further €335 million consists of amounts accruing during the year as Universal Service compensation2.

- A reduction of €73 million in trade payables and other current liabilities, primarily reflecting normal trends in the payment of suppliers.

- a €148 million increase in the balance of trade receivables and other non-current assets and liabilities, primarily due to tax assets deriving from the prepayment by Poste Vita SpA (for the years 2010-2014) of withholding and substitute tax on capital gains on life insurance policies.

At 31 December 2014, equity amounts to €8,417.9 million (€7,116.3 million at 31 December 2013) and breaks down as follows:

- Share capital €1,306.1 million

- Reserves €3,159.9 million

- Retained earnings €3,951.9 million.

Compared with 31 December 2013, equity has increased by €1,301.6 million due to the following changes:

Additions:

- a €1,141.8 million increase in fair value reserves net of tax, as a result of positive and/or negative movements in the value of investments in securities held by BancoPosta RFC and Poste Vita SpA;

- movements in the cash flow hedge reserves, amounting to €66.2 million, net of tax;

- profit for the year of €211.9 million;

- €535 million taken to retained earnings as a result of recognition of the amount due from the shareholder which, as described above, is required to return this sum to the Parent Company following the ruling of the EU Court of 13 September 2013, which has become final. As the payment of the sums under the Decision of 2008 were drawn from the Company’s portion of retained earnings accrued “ideally” from the returns on Poste Italiane SpA’s deposits with the MEF, the MEF’s obligation to return the above amounts has, accordingly, also been recognised in retained earnings, to the extent provided for by the 2015 Stability Law. Retained earnings also include taxation of €25.2 million on the interest component of the amount due from the shareholder.

Reductions:

- €500 million regarding the Parent Company’s payment of dividends to the shareholder;

- €128.1 million resulting from the recognition in equity of net after-tax actuarial gains and losses on employee termination benefits.

LIQUIDITY

| for the year ended 31 December (€m) | 2013 | 2014 |

|---|---|---|

| Adjusted cash and cash equivalents at beginning of year | 441 | 559 |

| Cash flow from/(for) operating activities | 448 | (119) |

| - cash flow generated by operating activities before movements in working capital | 1,135 | 1,098 |

| - movement in working capital | (51) | (420) |

| - financial assets and liabilities attributable to financial activities | (584) | (631) |

| of which BancoPosta deposits not yet invested in financial assets | 906 | (249) |

| - financial assets and liabilities attributable to insurance activities | (352) | (375) |

| - cash attributable to technical provisions for insurance business | 300 | 209 |

| Cash flow from/(for) investing activities | (720) | (347) |

| Cash flow from/(for) financing activities | 640 | 1,185 |

| Cash flow from/(for) shareholder transactions | (250) | (500) |

| Adjusted movement in cash | 118 | 219 |

| Adjusted cash and cash equivalents at end of year(1) | 559 | 778 |

| Amounts that cannot be drawn on due to court rulings | (17) | (16) |

| Current account overdrafts | (5) | (8) |

| Cash resulting from cash on delivery payments | (7) | (7) |

| Unrestricted net cash and cash equivalents at end of year | 530 | 747 |

(1) Cash and cash equivalents does not include the restricted component of cash deposited in the buffer account held at the MEF (€262 million at 31 December 2013 and €511 million at 31 December 2014) or the component of cash attributable to technical provisions for the insurance business (€624 million at 31 December 2013 and €415 million at 31 December 2014).

Reconciliation with statement of cash flows in financial statements

| 2013 | 2014 | |

|---|---|---|

| Adjusted cash and cash equivalents | 559 | 778 |

| Cash subject to investment restrictions | 262 | 511 |

| Cash attributable to technical provisions for insurance business | 624 | 415 |

| Net cash and cash equivalents at end of year | 1,445 | 1,704 |

Cash flows during the year were primarily affected by movements in working capital, due, among other things, to an

increase in trade receivables, which include amounts due as Universal Service compensation, and tax assets deriving

from the prepayment by Poste Vita SpA of withholding and substitute tax on capital gains on life insurance policies.

Cash generated was also used to finance capital expenditure and investment in financial assets, totalling €347 million.

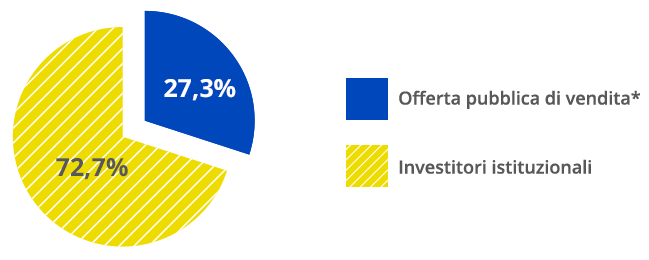

Cash flow from financing activities, on the other hand, primarily reflects the issue of subordinated bonds by the

subsidiary, Poste Vita, totalling €750 million. The bonds were placed in their entirety with institutional investors. A

further amount relates to a net increase in funding raised by the Parent Company, after repayments of repurchase

agreements.

Cash and cash equivalents, after the distribution of €500 million in dividends to the shareholder, amounts to €747

million (€530 million at the end of 2013).

Net funds at 31 December 2014 amount to €4,741 million (net funds of €3,257 million at the end of 2013), reflecting: the results of the fair value measurement of investments in available-for-sale financial assets (approximately €2,650 million); cash subject to restrictions, as shown in the following table, as attributable to technical provisions for the insurance business or subject to investment restrictions (BancoPosta RFC); net financial assets held by Poste Vita and Banca del Mezzogiorno-MedioCredito Centrale, which are subject to supervisory capital requirements (approximately €1,900 million).

| at 31 December (€m) | 2013 | 2014 |

|---|---|---|

| Financial liabilities | 51,770 | 55,358 |

| Technical provisions for insurance business | 68,005 | 87,219 |

| Financial assets | (118,467) | (142,687) |

| Technical provisions for claims attributable to reinsurers | (40) | (54) |

| Net financial liabilities/(assets) | 1,268 | (164) |

| Cash and deposits attributable to BancoPosta | (3,080) | (2,873) |

| Cash and cash equivalents | (1,445) | (1,704) |

| of which: | ||

| - Adjusted cash and cash equivalents | (559) | (778) |

| - Cash subject to investment restrictions | (262) | (511) |

| - Cash attributable to technical provisions for insurance business | (624) | (415) |

| Net debt/(funds) | (3,257) | (4,741) |

FINANCIAL POSITION AND CASH FLOW OF POSTE ITALIANE SpA

Poste Italiane SpA’s net invested capital amounts to €4,613 million (€4,500 million at 31 December 2013), 100% financed by equity.

| at 31 December (€m) | 2013 | 2014 | Increase/ (decrease) |

|---|---|---|---|

| Non-current assets | 4,676 | 4,643 | (33) |

| Working capital | 2,048 | 2,926 | 878 |

| Provisions for risks and charges | (1,089) | (1,247) | (158) |

| Employee termination benefits and pension plans | (1,302) | (1,434) | (132) |

| Deferred tax assets/(liabilities) | 167 | (275) | (442) |

| Net invested capital | 4,500 | 4,613 | 113 |

In addition to movements in non-current assets and working capital, the increase in net invested capital at 31 December 2014 reflects:

- a reduction of €442 million in the net balance of deferred tax assets/(liabilities), primarily due to the increase in the fair value reserve for BancoPosta’s investments in securities, which generated an increase in deferred tax liabilities;

- an increase of €158 million in provisions for risks and charges, primarily due to the effect of the expected liabilities for restructuring costs.

Non-current assets break down as follows at 31 December 2013 and 31 December 2014:

| at 31 December (€m) | 2013 | 2014 | Increase/ (decrease) |

|---|---|---|---|

| Property, plant and equipment | 2,367 | 2,171 | (196) |

| Investment property | 69 | 67 | (2) |

| Intangible assets | 428 | 375 | (53) |

| Investments | 1,812 | 2,030 | 218 |

| Non-current assets | 4,676 | 4,643 | (33) |

Compared with the end of 2013, non-current assets are down €32,5 million, as a result of reductions of €608.0

million and additions totalling €575.5 million.

Reductions regard depreciation, amortisation and impairments, totalling €578.6 million, of which €371.3 million

regards property, plant and equipment, €202.8 million intangible assets and €4.5 million depreciation and

impairments of investment property, after reversals of impairments. Further reductions in non-current assets regard:

- impairments of €25.1 million, reflecting the write-off of the value of Poste Italiane’s investments in Mistral Air Srl and PosteShop SpA (€19.9 million and €4.9 million, respectively) based on the results of the impairment tests conducted and available projections; a further impairment of €0.3 million regards the investment in Poste Holding Participações do Brasil Ltda, following the decision to place the company in liquidation;

- retirements and sales of €4.3 million, including €2.1 million regarding property, plant and equipment, €1.4 million intangible assets, €0.6 million investment property and €0.2 million non-current assets held for sale.

Additions regard:

- capital expenditure of €332.2 million, of which, as described in the section “Capital expenditure and financial investments”, 58% relates to investment in ICT (Information & Communication Technology), 32% to the modernisation and renovation of buildings and 10% to postal logistics. In more detail, additions during the year primarily regard: €180.6 million invested in property, plant and equipment, relating to the purchase of new hardware for the technological upgrade and restyling of post offices, in addition to non-routine maintenance of properties owned by the Company; €151.6 million invested in intangible assets, reflecting the purchase of new software licences and the development of software for network platforms;

- acquisitions of investments, totalling €242.8 million, which breaks down as follows: €232 million relating to the subscription for new shares issued by Banca del Mezzogiorno-MedioCredito Centrale SpA; €9.9 million in capital injections for Mistral Air Srl to cover losses incurred to 30 June 2014 and establish an extraordinary reserve; €0.8 million relating to the subscription for the new shares issued by Poste Holding Participações do Brasil Ltda; €70 thousand regarding the subscription for shares representing 58.12% of the consortium fund of Consorzio PosteMotori ScpA; and €2 thousand regarding the acquisition of 20% of Italia Camp Srl.

- purchases of investment property, totalling €0.5 million.

Working capital of breaks down as follows at 31 December 2014 and 31 December 2013:

| at 31 December (€m) | 2013 | 2014 | Increase/ (decrease) |

|---|---|---|---|

| Trade receivables and other current receivables and assets | 4,213 | 4,902 | 689 |

| Trade payables and other current liabilities | (2,945) | (2,656) | 289 |

| Current tax assets and liabilities | 616 | 604 | (12) |

| Trade receivables and other non-current assets and liabilities | 164 | 76 | (88) |

| Working capital | 2,048 | 2,926 | 878 |

Working capital at 31 December 2014 amounts to €2,926 million, up €878 million compared with the end of 2013. The increase is essentially due to the following:

- an increase of €689 million in trade receivables and other current receivables and assets. As previously noted in the section on the Group’s financial position, the main components of this balance essentially include receivables due from the State;

- a reduction of €289 million in trade payables and other current liabilities, reflecting normal trends in the payment of suppliers, and a reduction in the amount payable by the Parent Company to its subsidiaries after offsetting, in its role as consolidating entity for the tax consolidation arrangement2, payments on account made by the subsidiaries, withholdings paid and taxes paid overseas.

At 31 December 2014, equity amounts to €6,504.9 million and breaks down as follows:

- Share capital €1,306.1 million

- Reserves €2,933.9 million

- Retained earnings €2,264.9 million.

Compared with 31 December 2013, equity has increased by €1,074.7 million due to the following changes:

Additions:

- a €1,065.8 million increase in fair value reserves net of tax, as a result of positive and/or negative movements in the value of investments in securities held by BancoPosta RFC;

- movements in the cash flow hedge reserves, amounting to €66.2 million, net of tax;

- profit for the year of €56.9 million;

- €535 million taken to retained earnings, as previously noted in the section on the Group’s financial position, as a result of recognition of the amount due from the shareholder, the MEF, as provided for in art.1, paragraph 281 of the 2015 Stability Law. Retained earnings also include taxation of €25.2 million on the interest component of the amount due from the shareholder.

Reductions:

- €500 million regarding the Parent Company’s payment of dividends to the shareholder;

- €123.9 million resulting from the recognition in equity of net after-tax actuarial gains and losses on employee termination benefits.

LIQUIDITY

| for the year ended 31 December (€m) | 2013 | 2014 |

|---|---|---|

| Cash and cash equivalents at beginning of year | 192 | 234 |

| Cash flow from/(for) operating activities | 982 | (12) |

| - cash flow generated by operating activities before movements in working capital | 644 | 718 |

| - movement in working capital | 671 | (252) |

| - financial assets and liabilities attributable to BancoPosta | (333) | (478) |

| of which BancoPosta deposits not yet invested in financial assets | 912 | (334) |

| Cash flow from/(for) investing activities | (1,265) | (441) |

| Cash flow from/(for) financing activities | 575 | 1,017 |

| Cash flow from/(for) shareholder transactions | (250) | (500) |

| Adjusted movement in cash | 42 | 64 |

| Adjusted cash and cash equivalents at end of year(1) | 234 | 298 |

| Amounts that cannot be drawn on due to court rulings | (14) | (11) |

| Unrestricted net cash and cash equivalents at end of year | 220 | 287 |

(1) Cash and cash equivalents does not include the restricted component of cash deposited in the buffer account held at the MEF (€354 million at 31 December 2013 and €688 million at 31 December 2014).

Reconciliation with statement of cash flows in financials tatements

| for the year ended 31 December (€m) | 2013 | 2014 |

|---|---|---|

| Adjusted cash and cash equivalents | 234 | 298 |

| Cash subject to investment restrictions | 354 | 688 |

| Net cash and cash equivalents at end of year | 588 | 986 |

As noted previously with regard to the Group, cash flows during the year were primarily affected by significant

movements in working capital, due to an increase in trade receivables, which, among other things, include amounts

due as Universal Service compensation.

Cash generated was also used to finance capital expenditure of €332 million, to provide fresh capital to fund the

business development plans of the subsidiary, Banca del Mezzogiorno-MedioCredito Centrale SpA, totalling €232

million, and to subscribe Contingent Convertible Notes, totalling €75 million, issued by Midco SpA, which holds 51%

of Alitalia SAI. Financing activities also include amounts deposited by subsidiaries in intercompany current accounts.

Cash and cash equivalents, after the distribution of €500 million in dividends to the shareholder, amounts to €287

million (€220 million at the end of 2013).

Net funds at 31 December 2014 amount to €1,892 million (net funds of €930 million at the end of 2013), reflecting the results of measurement on the fair value reserve for investments in available-for-sale financial assets held by BancoPosta RFC (approximately €2,307 million).

| at 31 December (€m) | 2013 | 2014 |

|---|---|---|

| Financial liabilities attributable to BancoPosta | 48,702 | 50,499 |

| Financial liabilities | 2,548 | 3,506 |

| Financial assets attributable to BancoPosta | (46,502) | (50,287) |

| Financial assets | (2,010) | (1,751) |

| Net financial liabilities/(assets) | 2,738 | 1,967 |

| Cash and deposits attributable to BancoPosta | (3,080) | (2,873) |

| Cash and cash equivalents | (588) | (986) |

| of which: | ||

| - Adjusted cash and cash equivalents | (234) | (298) |

| - Cash subject to investment restrictions | (354) | (688) |

| Net debt/(funds) | (930) | (1,892) |

(1) Intangible assets consist of costs directly associated with the development of separable and identifiable software products that will provide future economic benefits for a period of more than one year. No research and development costs, other than those just described, are capitalised.

(2) Poste Italiane SpA has adopted a tax consolidation arrangement, which it has elected to apply in accordance with the related law

together with the subsidiaries, Poste Vita SpA, SDA Express Courier SpA and Mistral Air Srl. Following adoption of the tax

consolidation arrangement, the Parent Company’s tax expense is determined at consolidated level on the basis of the tax expense or

tax losses for the period for each company included in the consolidation, taking account of any withholding tax paid or payments

on account.

Areas of business

SERVICES

SERVICES

SERVICES

FINANCIAL SERVICES

BANCOPOSTA RFC

During 2014, BancoPosta RFC's commercial offering was focused on cross-selling and attracting new current account

deposits. In the private current account segment, the Conto BancoPosta Più offering has been expanded through the

introduction of new promotions: customers purchasing a Postaprotezione SiCura and/or a Postaprotezione Infortuni

insurance policy or purchasing PosteMobile products have had their annual current account fee cut to zero.

The Conto BancoPosta In Proprio offering for SMEs was restyled. Customers who retain a minimum balance on their

account each month and purchase or use a certain number of products (collection and payment or loans and

insurance) receive a reduction in their account charges.

A number of initiatives have also been taken to attract new deposits and consolidate the market positioning of online

current accounts. These regard:

- the launch of “Promozione 1,75%”, offering an annual rate of 1.75% gross until 31 December 2014 for all new customers opening a Conto BancoPosta Più or Conto BancoPosta Click account by 30 June 2014, whilst existing BancoPosta Click customers have been offered an annual rate of 0.75% gross until 30 June 2014;

- three different rates were offered for amounts deposited in term accounts as part of the “Opzione SorpRende” service, which allows customers to earn a higher return than usual if they deposit their money for a longer period; this option was also extended to In Proprio current accounts for SMEs.

The electronic money sector, in which the Group is present with its Postamat Maestro card (6.9 million cards at 31

December 2014 and 6.8 million cards at 31 December 2013) and Postepay card (12.2 million cards at 31 December

2014, compared with 10.5 million cards at 31 December 2013), saw the expansion of contactless debit card

technology to both cards in the Tuscany region (after Lombardy and Lazio, where distribution was completed in

2013), and to the Postamat Click MasterCard debit card throughout the country.

The new Postepay card, Postepay Evolution, was launched in 2014. In addition to having all the usual functions of a

standard Postepay card, the new card, which will be equipped with an IBAN, will enable holders to carry out the

principal banking transactions (to pay in their salaries, effect transfers and post office giro transactions and pay their

bills by direct debit) and to use an App to top up their cards with small amounts free of charge from other Postepay

accounts (up to €25 a day). The new card, which will belong to the international MasterCard system, will support

the United Nations’ World Food Programme (WFP) in collaboration with MasterCard and will be the first card in the

world to give customers the chance to make a donation to the WFP each time they use their card.

In connection with the La Carta dello Studente – IoStudio promotion sponsored by the Ministry of Education,

Universities and Research (MIUR), involving the distribution of electronic ID cards incorporating a number of payment

functions to students, during the first half around 600,000 cards for secondary school students were produced and

sent to school administrative offices.

Around 26.3 million top-ups were made using the external top-up channel for Postepay cards, comprising around 40

thousand SISAL betting shops, around 16 thousand tobacconists linked up to the Banca ITB network, and the home

banking service provided by the BPM Group and other authorised networks in 2014 (21.6 million in 2013).

In the collections and payments segment, the process of extending the payment of bills using payment slips in

supermarkets continued and a Payment Slip for the payment of the new property tax (TASI) was created as an

alternative to form F24. Furthermore, from October 2014 new functions were added to the Bollettino postale

(Payment Slip) product, enabling invoicers to electronically check unpaid bills and payments received in real time.

Again with regard to collections and payments, in June the new version of the “Fattura noproblem” service, which

manages the issue of bills to Public Sector entities in compliance with the relevant regulations on behalf of

BancoPosta current account customers, was released.

The POS acquiring services for SMEs include the Mobile POS service, the marketing of which was extended to the

entire post office network during the year. The introductory promotional offer, enabling customers to buy a card

reader at a reduced price, was also prolonged. The service is aimed at small and micro businesses, enabling them to

use a smartphone or tablet to manage credit and debit card payments by using a special app and a bluetooth card

reader.

The holders of PagoBancomat cards can now top up their mobile phones or their Postepay cards at a Postamat ATM

and the process of extending the number of post offices at which bills can be paid by payment slip using a Visa or

Mastercard debit or credit card was completed.

In terms of loan products for private customers, numerous low interest rate promotions were run and the terms and

conditions applicable to a number of products were revised. In particular, the offer of Specialcash Postepay and

Prontissimo BancoPosta personal loan products was extended to include the holders of the new Postepay Evolution

card, with the loans credited to their card and repayments being debited directly to the card. The range of Quinto

BancoPosta salary loans was extended, with the addition of both a product for Poste Italiane employees, enabling

them to obtain loans worth up to two-fifths of their salary, and one for INPS pensioners and Poste Italiane employees,

giving them the possibility to obtain a new BancoPosta salary loan to replace a previous one obtained from any other

bank. The Mutuo BancoPosta product (mortgage loans) was repriced in order to improve its competitiveness.

With regard to the distribution and management of Postal Savings products, 2014 saw changes to the range of

Interest-bearing Postal Certificates (BFPs), with the issue of certain products being halted (the 3-year BFP Fedeltà,

BFPRisparmiNuovi, BFPRenditalia, BFP7insieme) to be replaced by new certificates (e.g., BFP3x4Fedeltà, for customers

redeeming at maturity certificates or bonds distributed exclusively by Poste Italiane; Buono BFP3x4RisparmiNuovi,

aimed exclusively at savers desiring to top up their investments). In addition, the "risparmiodisicuro" plan was

launched in April, enabling savers to periodically and automatically subscribe for certain types of certificate (BFP

Europa, BFP Diciottomesi, BFP 3x4, BFP Ordinari and inflation-linked BFPs).

Turning to Savings Books, promotion of the Libretto Nominativo Smart product was extended. This offers a higher

rate of interest for qualifying customers (e.g., those who maintain a certain minimum balance on their account)

until 30 June 2014, for accounts opened between 1 January 2013 and 30 March 2014, and 31 December 2014,

for those opened between 1 April 2014 and 23 June 2014 (the latter promotion was renewed for accounts

opened between 24 June 2014 and 28 October 2014). In addition, new functions have been added to the online

services linked to the Libretto Smart product, enabling account holders to give instructions for: the transfer of funds

from bank current accounts; top-ups to their PostePay cards using an App to debit their Libretto Smart account,

transfers (from a Libretto Ordinario to a Libretto Smart and vice versa and from a BancoPosta/BancoPosta Click

current account to a Libretto Smart account and vice versa), using the RPOL service or via an App.

In terms of investment services, 2014 saw the issuance of three bonds:

- “TassoFisso Sprint BancoPosta”, issued by Banca IMI SpA, and

- “TassoFissoOneStep BancoPosta”, issued by UniCredit SpA, both having 6-year terms to maturity;

- “TassoFissoOneStep BancoPosta”, issued by Banca IMI, with a term to maturity of 7 years.

With regard to International Money Transfer payment systems, a number initiatives were taken to boost usage of the Moneygram service. These focused on use of a Poste Mobile SIM, based on a promotion launched in February, enabling customers to transfer money to any country in return for a flat fee, and pricing initiatives for money sent from Rome, Milan and Naples. In addition, with regard to Eurogiros, the Eurogiro Cash to Account service for sending money from San Marino to Italy, directly to the recipient’s postal current account, was also launched.

Online services

Online home banking services linked to the BancoPosta (BancoPostaOnline) and Conto BancoPosta Click accounts continued to see growth in 2014, with over 1.7 million online consumer accounts (over 1.5 million online consumer accounts active at the end of 2013) and around 257,000 business accounts (around 250,000 at the end of 2013).

Online transactions

| in the year ended 31 December ('000) | 2013 | 2014 | % inc./(dec) |

|---|---|---|---|

| Payment of bills by payment slip | 5,242 | 5,715 | 9.0 |

| Bank transfers | 3,525 | 4,248 | 20.5 |

| Post office giros | 1,520 | 1,792 | 17.9 |

| PostePay top-ups | 5,126 | 5,414 | 5.6 |

| Phone top-ups | 4,135 | 3,728 | (9.8) |

| Tax payments (using the F24 form) | 1,511 | 2,096 | 38.7 |

| Interest-bearing Postal Certificates | 68 | 53 | (22.1) |

| Other | 75 | 83 | 10.7 |

| Total | 21,202 | 23,129 | 9.1 |

Online customers generated more than 23 million instructions during the year (21 million in 2013). Of the classic

internet banking services offered, the Bollettino payment slip is the most successful, with 5.7 million online

transactions generated in 2014 (up 9% on 2013), followed by PostePay top-ups (up 5.6% on the previous year, with

5.4 million top-ups) and bank transfers which, with over 4.2 million instructions, are up 20.5% on 2013. Post office

giro transactions, transferring money between Bancoposta current accounts, totalled approximately 1.8 million (up

17.9% on the previous year).

The number of phone top-ups is down 9.8% from the 4.1 million of 2013 to 3.7 million in 2014. This reflects general

market trends, with increased use of social networks as a means of communication and of mobile messaging Apps.

BANCOPOSTA’S OPERATING RESULTS

Revenue

| for the year ended 31 December (€m) | 2013 | 2014 | % Inc./ (Dec.) |

|---|---|---|---|

| Current Accounts | 2,931 | 2,775 | (5.3) |

| Payment of bills by payment slip | 567 | 493 | (13.1) |

| Income from investment of customer deposits | 1,753 | 1,659 | (5.4) |

| Other revenue from current accounts and prepaid cards | 611 | 623 | 2.0 |

| Money transfers(*) | 63 | 55 | (12.7) |

| Postal savings and investment | 2,004 | 2,040 | 1.8 |

| Postal Savings Books and Certificates | 1,620 | 1,640 | 1.2 |

| Government securities | 8 | 6 | (25.0) |

| Equities and bonds | 14 | 3 | (78.6) |

| Insurance policies | 329 | 361 | 9.7 |

| Investment funds | 17 | 18 | 5.9 |

| Securities Deposits | 16 | 12 | (25.0) |

| Delegated Services | 130 | 136 | 4.6 |

| Loan products | 127 | 120 | (5.5) |

| Other products(**) | 71 | 102 | 43.7 |

| Total revenue from financial services | 5,326 | 5,228 | (1.8) |

| Reconciliation with BancoPosta's Separate Report(***) | (11) | (5) | (54.5) |

| BancoPosta RFC's interest and fee and commission income | 5,315 | 5,223 | (1.7) |

(*) This item includes all revenue from domestic and international money orders and inbound and outbound Eurogiros.

(**) This item includes revenue from tax collection forms and tax returns and other Bancoposta revenue.

(***) This item primarily includes income from the investment of own liquidity and certain financial income classified, for the purposes of the Separate

Report, in other items in the income statement.

Deposits

| at 31 December (€m) | 2013 | 2014 | % Inc./ (Dec.) |

|---|---|---|---|

| Current accounts(*) | 43,903 | 43,953 | 0.1 |

| Postal savings books(**) | 106,920 | 114,359 | 7.0 |

| Interest-bearing postal certificates(**) | 211,707 | 211,333 | (0.2) |

(*) This refers to the average deposits during the period, including time deposits, repurchase agreements and Poste Italiane's liquidity.

(**) Deposits include accrued interest for the period, calculated on the assumption that all Interest-bearing Postal Certificates arrive at their scheduled

maturity date.

Number of transactions

| in the year ended 31 December ('000) | 2013 | 2014 | % Inc./ (Dec.) |

|---|---|---|---|

| Payment slips processed | 457,612 | 428,467 | (6.4) |

| Domestic postal orders | 5,830 | 5,438 | (6.7) |

| International postal orders | 2,642 | 2,215 | (16.2) |

| Inbound | 1,460 | 1,077 | (26.2) |

| Outbound | 1,182 | 1,138 | (3.7) |

| Pensions and other standing orders | 77,865 | 77,135 | (0.9) |

| Tax services | 29,361 | 50,827 | 73.1 |

Volumes

| at 31 December ('000) | 2013 | 2014 | % Inc./ (Dec.) |

|---|---|---|---|

| Number of customer current accounts | 6,023 | 6,173 | 2.5 |

| Number of credit cards | 459 | 457 | (0.4) |

| Number of debit cards | 6,756 | 6,896 | 2.1 |

| Number of prepaid cards | 10,550 | 12,175 | 15.4 |

Revenue generated by BancoPosta RFC’s financial services is down from the €5,326 million of 2013 to €5,228 million

in 2014 (a decline of 1.8%). This primarily reflects the performance of current accounts, which saw a 5.3% reduction

in revenue (€2,775 million in 2014, compared with €2,931 million in 2013). This reflects both a decline in revenue

from the payment of bills by payment slip, down 13% from €567 million in 2013 to €493 million in 2014, due to a

decline in the number of bills processed (458 million in 2013, compared with 428 million in 2014), and a 5.4%

reduction in revenue from the investment of deposits (€1,659 million in 2014, compared with €1,753 million in 2013),

reflecting a reduction in the average rate earned on deposits with the Ministry of the Economy and Finance.

Other revenue from current accounts and prepaid cards is up by approximately €12 million, reflecting an increase in

fee revenue on the issue and use of prepaid cards, which amount to 12.2 million at the end of 2014, compared with

10.6 million at the end of 2013.

There was a 12.7% decrease in money transfer revenue (€55 million in 2014, compared with €63 million in 2013),

essentially due to falls in the volume of domestic transfers processed (5.4 million transaction in 2014, compared with

5.8 million in 2013) and in the number of international transfers (2.2 million transactions in 2014, compared with 2.6

million in 2013).

The sale of Interest-bearing Postal Certificates and inflows into Postal Savings Books, the income on which is linked to a mechanism agreed with Cassa Depositi e Prestiti SpA tied to the achievement of net savings inflow targets, contributed €1,640 million to revenue (€1,620 million in 2013). In terms of assets under management, savings book deposits amount to €114.4 billion at 31 December 2014 (€106.9 billion at 31 December 2013), whilst savings in the form of Certificates are substantially in line with the figure for 31 December 2013 (€211.3 billion at the end of 2014, compared with €211.7 billion at the end of 2013).

Asset and fund management1 registered an increase in revenue of 4.2% (€400 million in 2014, compared with €384 million in 2013), generated essentially by growing sales of insurance policies (up 9.7%), which have risen from the €329 million of 2013 to €361 million in 2014. This reflects an 11% increase in premiums written by Poste Vita (€14.7 billion in 2014, compared with €13.2 billion in 2013), with the remaining increase deriving from the positive contribution of commission income from the funds segment, up from €17 million in 2013 to €18 million in 2014. Equity and bond placement revenue is down 78.6% on 2013 (€3 million in 2014, compared with €14 million in 2013), due to a reduction in the volumes placed (€110 million in 2014, compared with €589 million in 2013). Delegated service revenue of €136 million (€130 million in 2013) primarily includes commissions received in return for the payment of INPS (National Social Insurance Institute) pensions, totalling €69 million (€63 million in 2013), and commissions earned on the payment of pensions and other sums for the Ministry of the Economy and Finance, totalling €57 million. The decrease in commissions was basically due to the reduction in pensions paid at counters as opposed to current or savings account credits, on which a lower commission is charged than for counter payments.

Revenue from the distribution of loan products2 is down 5.5% (€120 million in 2014, compared with €127 million in 2013), reflecting a reduction in the amounts disbursed.

Finally, the 43.7% increase in revenue from other products essentially reflects growth in the number of tax payments processed using the F24 form (51million in 2014, compared with 29 million in 2013).

(1) Asset and fund management includes the distribution of government securities, equities, bonds, insurance policies, mutual

investment funds and commissions on safe custody accounts.

(2) Personal loans, mortgage loans, overdrafts, salary loans and credit protection.

FINANCIAL SERVICES

BANCA DEL MEZZOGIORNO - MEDIOCREDITO CENTRALE SPA

During 2014 Banca del Mezzogiorno-MedioCredito Centrale (MCC) continued to provide support for creditworthy

companies operating in southern Italy, through its lending activities and by promoting and facilitating access to

government subsidies.

In February the bank raised fresh capital of €232 million in order to fund an expected increase in medium/long-term

lending. In this respect, the bank set up various distribution channels to increase penetration of the various segments

and markets. Alongside loan products, associated with collateral or personal guarantees, to support the investment

needs of manufacturing companies operating in the eight regions that make up southern Italy, MCC also added a

line of products to its offering for households (primarily mortgages and personal salary loans), enabling it, among

other things, to diversify risk and reduce funding costs.

The bank’s management of public funds and subsidies, and above all of the Fondo di Garanzia per le PMI (a

guarantee fund for SMEs), continued to expand: applications, numbering over 89,900, are up 7.9% on 2013, with

over 86,000 approved loans, totalling approximately €13 billion (up 19.7% compared with 2013).

Regarding the incentives for national research projects promoted by the Ministry for Economic Development (MISE),

as head of temporary consortium of companies, the bank was awarded a contract to provide an assistance and

support service for research, development and innovation project subsidies within the scope of the Sustainable

Growth Fund. The Fund promotes various types of initiative, including those aimed at supporting technological

research and development projects.

In 2014 the bank reported net income from banking activities of €100.6 million (€64.2 million in 2013) and net

interest income of €43.7 million (€21.1 million in 2013). Total loans and advances amount to €1.3 billion at the end of

2014, compared with the €771 million registered at the end of 2013. Net fees are also up (€41.1 million in 2014,

compared with the €35.4 million in the previous year), primarily generated by management of the Fondo Centrale di

Garanzia per le PMI (central guarantee fund for SMEs).

Net profit for 2014 amounts to €37.6 million (€11.6 million in 2013).

FINANCIAL SERVICES

BANCOPOSTA FONDI SPA SGR

BancoPosta Fondi SpA SGR continued to carry out activities regarding Collective Investment Undertakings – UCIs and the Individual Investment Portfolio service in 2014.

Total assets under management in relation to the company's lines of business (individual and collective investment

services) amount to €62.2 billion at 31 December 2014 (up €16.3 billion or 36% on the end of 2013).

Regarding the investment portfolio management service provided to the Poste Vita Insurance Group, total assets